Celebrating 10 years of CRISIL Foundation

People recognise me as a financial health expert in my village. This gave me the confidence to pursue my dream - to become a member of the Panchayat.

From a homemaker, dependent on my husband for money, I have grown into a Sakhi earning my own income. I do what I’m passionate about - helping my neighbours avail of financial services and government schemes. People recognise me as a financial health expert in my village. This gave me the confidence to pursue my dream - to become a member of the Panchayat. Earlier, I did not have the confidence. But with people seeing me differently, I campaigned as an independent candidate. I won a seat in the Gram Panchayat! This has helped me support Mein Pragati Field Officers as they organise panchayat level meetings to raise awareness and enroll more villagers in government schemes and credible financial schemes.

of Gram Panchayat

Morigoan, Assam

Our SHG received a loan. Some of us now run small shops, or rear buffaloes

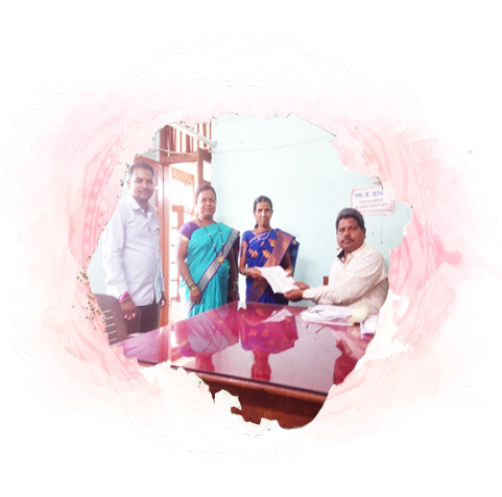

When my Self-Help Group (SHG) applied for a loan, we struggled to understand bank documentation and formalities. Then I happened to meet Poonam Devi - the Centre Manager of the Moneywise Centre for Financial Literacy, Tauru. I spoke to her about the trouble we were facing in understanding the process and organising paperwork.

Poonam accompanied us to the bank branch and helped with all formalities. Our SHG received a loan. Some of us have set up small shops, or begun rearing buffaloes. We have even started repaying loan installments.

Reaching people in cities used to be a rarity for us village folks. But I am now living this dream.

Every woman in Assam weaves for herself, for her family. My story is similar. The closest I have been to selling anything is Eri cocoon (from which eri or non-violent silk is produced). But I don’t want to remain a small time village seller who struggles to get by. I have begun selling what I weave and it’s more than gamusas (traditional handwoven Assamese cloth). I want to purchase a modern loom so that I can weave more of the designs I have learned and sell more.

My handloom has given me financial independence

Weaving makes me nostalgic about my childhood - my grandmother would drape a gamusa (traditional handwoven cloth) around her neck, singing softly as she lit the evening lamp. Now, I am married and have children of my own. Weaving for them on special occasions brings me much joy. Besides the gamusas and mekhla chador, I learned to weave curtains and cushions covers. My dream is to be successful so that my children see me as a role model.

Sensing my apprehension, Swapnil and his team accompanied me to the Revenue Department, to file a claim for the Aam Aadmi Bima Yojana.

I am a daily wage worker. A few years ago, my world came apart when my husband suddenly passed away.

I had an insurance certificate, but didn’t know what to do with it. Recently, Swapnil Agre (representative of the local Moneywise Centre for Financial Literacy) came to my village. He spoke about the Aam Aadmi Bima Yojana. When I showed him my certificate, I learned that I was a nominee and was eligible for a death claim for my husband! But there was a four-year gap between the time of death and the claim. I was apprehensive. So the team accompanied me to the Revenue Department to submit documents for the claim. In a few days, I received a deposit of Rs.30,000 in my savings account to settle the claim!

I had Rs. 4 lakh, but I kept it with me at home. I thought it was the safest and easiest thing to do. I know better now.

I work at a local shop and lives with my elder sister in Pachgaon, a village in Tauru (Mewat/Nuh) district. One day, some people from the MoneyWise Centre for Financial Literacy came to meet us. I pondered over the matters they discussed. I had Rs. 4 lakh, but I kept it with me at home. Until then I thought it was the safest and easiest thing to do. But now, a bank account seemed like a nice idea. I went to the centre, and met the staff. They helped me set up my own bank account with which I invested in a Fixed Deposit. I’m assured that my money is safe, and is working for me! I’ve also advised a few of my neighbours when they approached me about the procedures. I feel confident to manage my own money, smartly.