- Banking

- BFSI

- Blog

- Financial Services

- ESG

Gauging green, in black and white

Impact reporting on green bond investments sees traction

Rahul Agarwal

Head of ESG Research Services,

Crisil Global Research & Risk Solutions

Vignesh Rajaram

Sector Lead,

ESG Research Services,

Crisil GR&RS

Many investors want to know what happens after green bonds hit the market.

A relevant question, given the growing interest. Fund managers have stepped up on impact reporting, or disclosing the effects the monies raised through such bonds are having on sustainability goals.

According to a survey conducted by Environmental Finance, an online news and analysis service reporting on sustainability, the percentage of funds issuing impact reports covering the entire portfolio increased to 75% in 2022, up from 72% in 2021 and 66% in 20201.

Here are some more emerging trends.

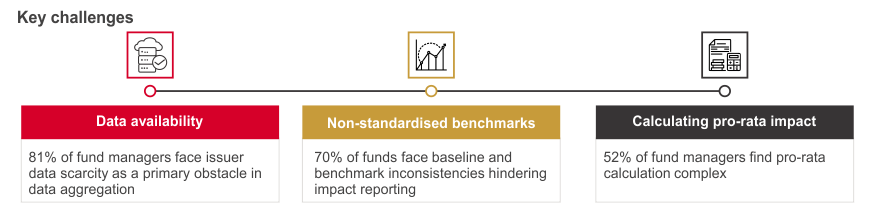

Fund managers are still grappling with data and inconsistency issues, while reporting fund-level impacts.

Challenges in impact reporting

Data availability

Data availability remains a major stumbling block for developing credible impact metrics. Inconsistencies arise from varying levels of data granularity. Some issuers present per-project impact data while others disclose overall bond metrics. This variation is further compounded by the fact that investors are increasingly demanding additional metrics around environmental and social considerations of projects. This makes it difficult for fund managers to gather data, since issuers may not be able to provide the same.

Non-standardised benchmarks

Another challenge is lack of uniformity in baselines used by issuers in calculating impact metrics. The use of disparate baselines makes it challenging for fund managers to present a comparable picture of different green bonds. Without standardised reporting practices, it also becomes hard to aggregate impact data at a larger scale, hindering the ability to assess the collective contribution of green bond funds.

Calculating pro-rata impact

Green bonds are often not the sole source of financing for a project. But how to divvy up the impact across instruments? Calculating the pro-rata impact would involve determining the proportional contribution of each individual green bond to the overall impact achieved by the fund. However, limited adoption of pro-rating as a practice poses a challenge for fund managers in providing precise impact estimates of their portfolios.

Best practices that can help

Fund managers can enhance their impact reporting by imbibing the following practices to enhance reporting quality and better align it with investor expectations:

Adopt a granular reporting approach

Granular reporting enhances the credibility and effectiveness of green bond funds. This includes per-project level disclosures and pro-rata calculations to measure precise impact. Per-project reporting shows the direct influence of each project on sustainability objectives, providing transparency to investors and stakeholders. Pro-rata calculations ensure accurate reporting by calculating the impact of each green bond based on its proportional contribution, offering investors a more credible approach to understand the environmental and social outcomes achieved through their investments.

Normalise the baseline

Normalisation is essential for consistent and comparable data. It enables investors to gauge the effectiveness of individual projects in achieving sustainability objectives, and their comparability. Impact reporting frameworks such as Green Bond Principles stress the significance of normalisation, helping green bond funds align with industry best practices and regulatory requirements through standardised methodologies.

Leverage sector expertise

Sector experts play a crucial role in identifying and defining relevant impact metrics that are tailored to the specific projects financed by green bonds. This ensures that reporting aligns with industry practices. Collaborating with these experts will ensure impact of green bond funds is measured and relevant environmental and social outcomes are conveyed, providing transparent and meaningful information to investors and stakeholders.

Engage with issuers

Fund managers must collaborate with issuers to establish transparent reporting standards and define reporting expectations. They could jointly work to define key performance indicators and impact metrics specific to green bond projects. In our interactions with clients, we have noticed that a few of them actively follow up for periodic reporting with issuers. This proactive approach ensures that the reported data aligns with the fund's sustainability objectives, generating meaningful insights for investors and reinforcing the credibility and transparency of the impact reporting process.

In conclusion

Growing demand for sustainable investments has fuelled the green bond market's growth, but challenges remain in measuring and communicating their impact effectively. To tackle them, fund managers can employ diverse strategies, such as leveraging sector expertise, adopting a granular reporting approach, ensuring baseline normalisation, and proactively engaging with issuers.

Additionally, evolving regulations could play a pivotal role in reinforcing the importance of consistent and comparable reporting practices.

Reference:

1Green Bond Fund Impact Reporting Practices 2023 [environmental-finance.com]

Subscribe to our blogs