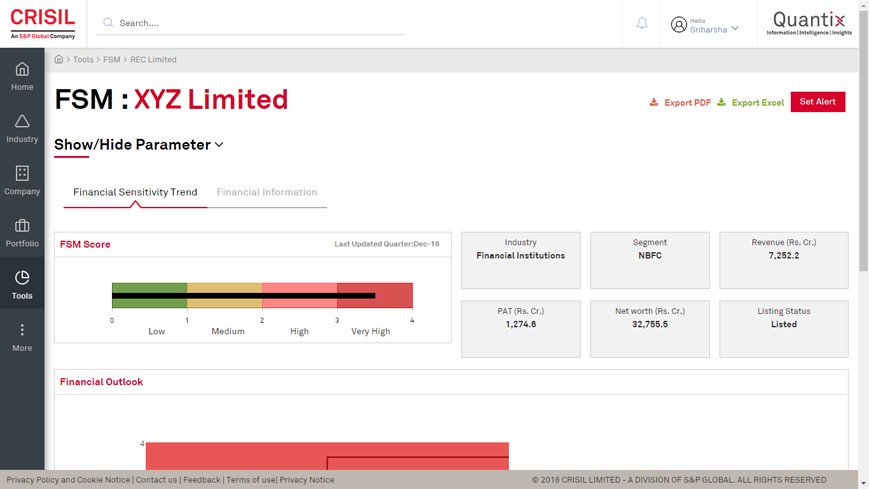

Financial Sensitivity Model

Quantix Financial Sensitivity Model is your one-stop solution to identify triggers that weaken companies' financial credit profiles.

- Proactively recognize companies with deteriorating financial health, with our consolidated credit view across agencies

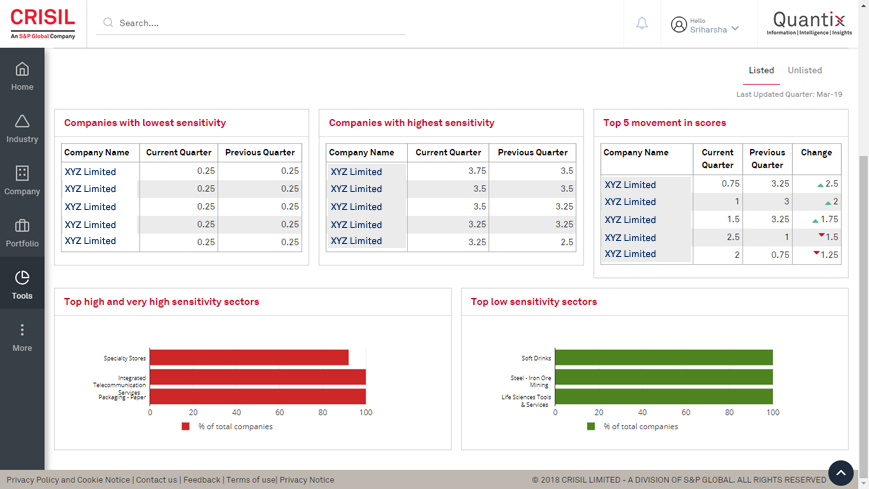

- Take pre-emptive steps to facilitate optimal, risk-based pricing of debt by identifying potential stress points

- Adjustments to financial parameters based on inputs from CRISIL experts

- Leverage the Industry Risk Score - CRISIL's proprietary framework based on several qualitative and quantitative parameters

- Assess performance with respect to peers

- Decipher the reason for change in financial health using a RAG-tagging classification

Our module segregates companies into heterogeneous groups of varying financial stress – companies with deteriorating financial profiles are grouped in the high financial sensitivity category and others in low financial sensitivity.

Gauge weakening in financial strength in companies