Sustainability Solutions

Uncertain times often demand a change in the status quo.

In 2021, Crisil made a first-of-its-kind attempt to assess India’s top 225 listed companies on environmental, social and governance (ESG) parameters, offering stakeholders cutting-edge, independent insights to make better-informed decisions in building a sustainable future.

One year on, ESG has moved from sporadic boardroom discussions to policy-level changes and, increasingly, on-ground implementation.

Companies are now going beyond template compliance and altruistic suasion, and perceiving the value that ESG is adding to their businesses.

They have begun internalising sustainability. That, in turn, should set off a virtuous cycle.

Crisil Sustainability Yearbook, 2022

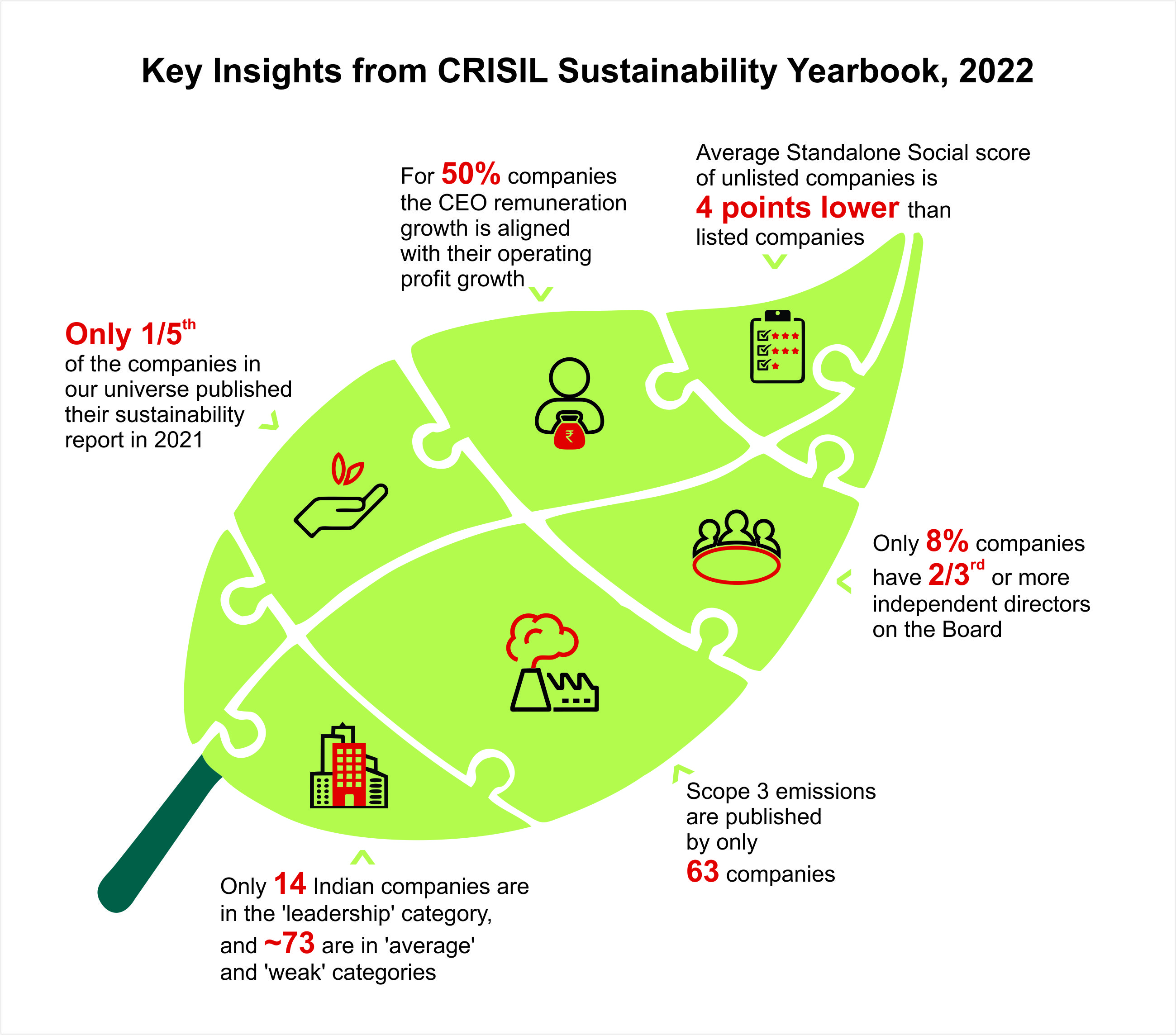

The Crisil Sustainability Yearbook is one of the most comprehensive annual publication based on our proprietary ESG framework on Indian companies.

In its second edition, the Yearbook covers latest global and domestic developments in the ESG space, incorporation of climate risks by global financial institutions, de-carbonization of hard-to-abate sectors in India, implications of transitioning from BRR to BRSR for Indian companies, gleanings from our ESG roundtable and insights on ESG trends based on the scores and data of 575+ Indian companies.

518

LISTED INDIAN COMPANIES ASSESSED

68

UNLISTED INDIAN COMPANIES ASSESSED

95%

Equity AUM COVERED

94%

Debt AUM COVERED

53

SECTORS COVERED

100

EVALUATION PARAMETERS

350

DATA POINTS COLLECTED

Yearbook Quicklinks

As ESG investing becomes more mainstream, both in developed and emerging markets, various stakeholders - from regulators to industry bodies, financial institutions and corporates - are coming together to move the needle on ESG.

This chapter highlights are some of the latest developments on this front both on the global and the domestic side.

As climate risk becomes critical in global discussions, we discuss the role of regulators in intensifying these efforts across countries, TCFD as an important tool to track these risks, and deliberate on how this space will evolve.

Until now, most regulations and government efforts have focused on the power and transportation sectors when it comes to decarbonization.

However, attention is shifting to the manufacturing sector. In this chapter, we look at a few critical sectors to understand how India aims to traverse the next 7-8 years in its efforts in energy optimisation.

As Indian companies begin their transition from BRR to BRSR reporting requirements, we delve deep into the various differences between the two in order to give readers an understanding of the ask ahead.

We also undertake a comparison of the BRSR with global reporting frameworks like GRI, SASB and TCFD to highlight the overlaps and its relevance to global investors.

In April this year, Crisil hosted investors and lenders for a roundtable to discuss the value of ESG, practical issues around its implementation, their role in moving the ESG needle in India, and potential recommendations for regulators.

The CXOs who attended represent a significant proportion of the financial institution community and are torchbearers in the ESG and sustainability space in India. Here are some of the key insights that emerged from the discussion at the meet.

With coverage of over 550 companies, across 53 sectors, we bring to you insights never seen before with respect to the Indian ESG space.

How do the companies perform on E,S and G parameters, how unlisted companies fare against listed counterparts, how do private companies stack up vis-à-vis PSUs…all this and much more await you in this chapter.

In this chapter, we discuss the global developments in the credit ratings space and how Crisil Ratings views ESG in its own ratings process.

In this chapter, we detail the proprietary ESG methodology used to arrive at our scores and analysis, our approach to handle unique challenges and our key differentiators, .

Crisil’s ESG scores are designed to support financial institutions and corporates to measure and monitor inherent ESG risks across their financial exposures – both equity and debt.

They also provide standardised and sanitised ESG information, including benchmarks that can easily integrate into analysis and risk management processes.

Explore our Sustainability Solutions

We’re here to help you successfully navigate the transition to a sustainable future. We provide various solutions to complement your journey towards Sustainability.

Our comprehensive coverage of Indian companies and various data points, provides decision useful ESG Scores of listed and unlisted companies in India. Benefit from an in-depth assessment of ESG performance and company level analysis on their ESG scores through our detailed rationale reports. Click here to view the Crisil ESG Score 2021

ESG Customized Solutions

Match your needs to unparalleled data and insight spanning various topics like ESG performance, net zero, energy transition, sustainable financing, delivering positive sustainable impact and BRSR reporting. Make sustainable decisions with conviction.

ESG Training Solutions

Our training solutions aims to meet the needs of a variety of organisations, whatever their level of maturity. Meet the growing demand of ESG implementation by gaining practical insights and technical knowledge.

Going beyond obligation, internalising sustainability

Crisil Sustainability Yearbook, 2022