Our recommendations

- Petroleum

- Crisil Ratings

- Diesel

- Crude Oil

- Ratings

- Revenue

Mumbai

Mumbai

State sales tax collections could rise upto 9% this fiscal despite Covid-19

Would be a crucial breather amid bleak revenue scenario this fiscal

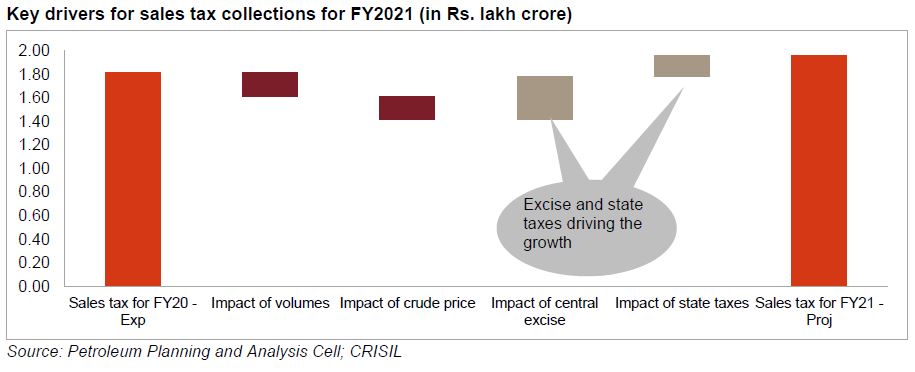

Sales tax collection of states on petroleum products (such as petrol and diesel) is set to recover sharply, driven by a rebound in volume, the full impact of increase in central and state taxes, and firmer crude oil prices.

If these drivers sustain, there could be a 7-9% on-year rise in sales tax receipts to ~Rs 1.96 lakh crore, despite an expected ~25% fall in collections in the first quarter on-year.

Says Manish Gupta, Senior Director, Crisil Ratings, “The first quarter saw petrol and diesel sales volume plunging by a third on-year because of the Covid-19 induced lockdown. But with the economy slowly unlocking and industrial and commercial activities clawing back, vehicular traffic has started to improve.”

Combined monthly volume of petrol and diesel sales (which account for 90% of sales tax collections from petroleum products) nearly doubled from 43%1 in April to 85% in June, though it dipped marginally in July (~83% on-year). If economic activity rebounds to pre-pandemic levels by November, the annual volume decline may be restricted to 11-12% this fiscal.

Says Ankit Hakhu, Director, Crisil Ratings, “Another kicker to improving collections is higher excise duty. Central excise duty was raised in March and May 2020. An increase in excise duty increases the taxable value2 of petrol and diesel for the levy of state sales tax3. This higher taxable value of the fuel is providing additional sales tax of ~Rs 3 per litre to states on weighted average basis4. In addition, many states have directly raised their sales tax rates, too, by ~Rs 1.5-1.8 per litre for the current fiscal.”

Similarly, crude oil prices, which averaged more than $60 per barrel last year and declined to $30 per barrel in the first quarter, have rebounded to ~$40 per barrel. Sustenance at these levels will support state receipts. Typically, a $10 increase in the crude oil price provides an additional Rs 1 per litre of fuel (petrol and diesel) sold to the state exchequer.

Sales tax on petroleum products contributes a sizeable ~15% to states’ own tax revenues. Thus, the expected recovery in collections should offer a breather to state finances, which have been under pressure since the lockdown began.

That said, the calculus presumes gradual normalisation of economic activity and no further lockdowns. However, the pandemic has been an unprecedented event and the duration and extent of its impact is unfathomable at present. Any future lockdowns to control the spread of fresh infections can hard-brake recovery in sales volume and sales tax collections thereof.

1 As % of last year volumes

2 The taxable value (for levying state sales taxes) for petrol/diesel is a function of crude oil price, foreign exchange rate, refinery processing cost and margins, freight cost, central excise rate and dealers margin; Retail price is taxable price + state sales tax

3 State tax rates varies across states and are either 1) ad-valorem (proportion to the estimated value of sales), 2) fixed value (in Rs./litre) or 3) max of 1 and 2. Almost 80% of the fuel consumption currently is in states with ad-valorem tax structure.

4 In volumes terms

Subscribe for our press releases

GreyLine

Questions?

Media relations

Saman Khan

Media Relations

Crisil Limited

D: +91 22 3342 3895

M: +91 95 940 60612

B: +91 22 3342 3000

saman.khan@crisil.comManish Gupta

Senior Director - Crisil Ratings

Crisil Limited

B: +91 124 672 2000

manish.gupta@crisil.comAnkit Hakhu

Director - Crisil Ratings

Crisil Limited

B: +91 124 672 2000

ankit.hakhu@crisil.com