- Blog

- Private Market

- Data-Driven Decision Making

- Data Management

- LP communication

- Data driven insights

Empowering private markets with data-driven decision making

Pradeep Rajwani

Director

Buy-side Practice

Crisil Integral IQ

Pankaj Daga

Associate Director

Buy-side Practice

Crisil Integral IQ

The private markets industry has experienced significant growth over the last decade, driven by increasing allocations to alternative asset classes and heightened investor demand for returns. Alongside this growth, private asset managers, or Alternative Investment Managers (AIMs), face mounting challenges such as evolving regulatory landscapes, greater reporting requirements, and the complexity of managing disparate data sources.

To thrive in this environment, AIMs must adopt a data-driven approach to enhance decision-making, improve operational efficiency, and foster stronger Limited Partner (LP) relationships. This blog explores the challenges, solutions, and opportunities for AIMs in leveraging data and technology to stay competitive.

The role of data in Private Markets

Data is the backbone of effective decision-making in private markets. AIMs use data analytics to:

- Drive informed decision-making: Access to real-time, actionable data helps AIMs identify new investment opportunities, monitor portfolio performance, and anticipate market trends.

- Optimize portfolios: Data-driven insights enable managers to pinpoint underperforming assets and implement strategies for improvement.

- Enhance risk management: Leveraging data helps identify potential risks and create contingency plans.

Improve operating efficiency: Automated workflows and streamlined data processes reduce manual errors and save time.

However, AIMs often encounter hurdles that limit their ability to fully utilize the power of data

Challenges in data management

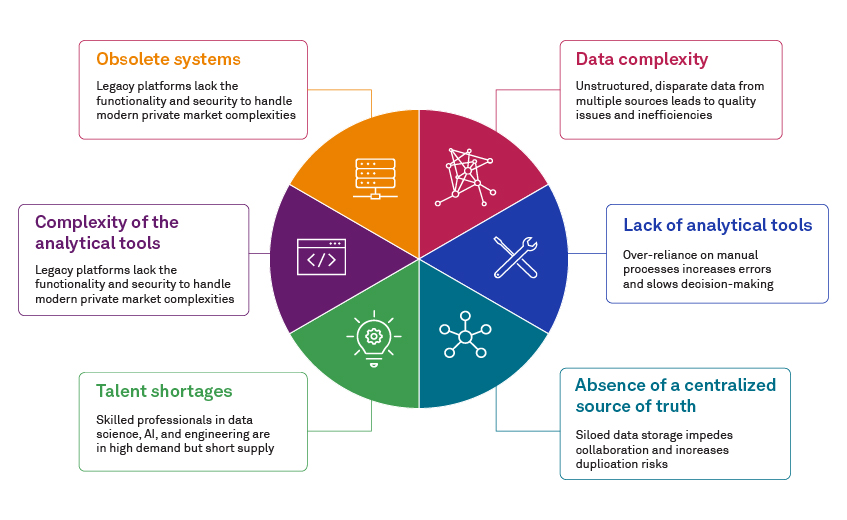

Despite its importance, many AIMs struggle to overcome key data management challenges, such as:

These challenges underline the necessity of adopting modern solutions

Solutions for data challenges

To address these issues, AIMs are turning to a combination of technology and service models:

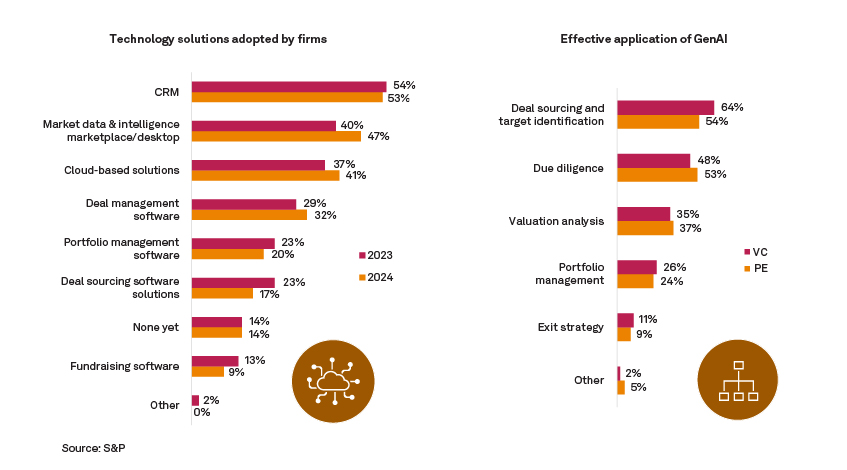

Technology’s role in investment management

Technology is reshaping the private markets landscape in several ways:

Data extraction and decision-making: With AI technologies, such as natural language processing, firms can extract, standardize and process data more effectively, leading to more informed decision-making.

Enhance portfolio management: With advanced portfolio analytics, data-driven statistical models and real-time performance monitoring systems, AIMs can identify trends and identify untapped investment opportunities.

Automation solutions: By embracing automation technologies such as robotic process automation (RPA) and cloud-based solutions, firms can mechanize repetitive tasks, consolidate and streamline unstructured data, and improve accuracy.

Regulatory compliance: Regulatory technology (RegTech) solutions can help private market firms navigate the complex regulatory landscape by automating compliance checks, boost regulatory capabilities, and ensure that all transactions adhere to legal and regulatory requirements.

Assessing implications of developing technology capabilities in-house vs. partnership

When building technological capabilities, AIMs can opt for in-house systems, partnerships, or hybrid models. Each approach offers distinct benefits and drawbacks:

AIMs must evaluate their specific needs, budgets, and strategic goals to choose the best approach

Data-driven insights enhancing LP communication

With institutuional investors diversifying their exposure to private markets and a notable rise in retail investor demand, firms are grappling with an increased load of reporting requirements to improve investor experience and relationship. As such, AIMs need actionable insights into data derived across investment performance, sector exposure analysis and risk profiles. This warrants robust data analytics to provide real-time, comprehensive reporting (such as configurable dashboards, automated reporting templates, etc.) to clients in a digital format.

By embracing a data-centric culture and leveraging advanced data analytics in LP reporting, AIMs benefit from:

Conclusion

In the rapidly evolving private markets, data-driven insights are no longer optional-they are a competitive necessity. AIMs that embrace technology, optimize data processes, and foster a culture of innovation will be better positioned to manage risks, attract investors, and achieve operational excellence.

As private markets grow increasingly complex, the firms that adapt and evolve will lead the industry into a future defined by efficiency, transparency, and sustainable success.

Subscribe to our blogs