- Blog

- Crisil Integral IQ

The Capital Cure

How Private Debt and Capital Solutions Are Reshaping Corporate Restructuring Strategies

by Pradeep Rajwani, Director Buy-side Practice, Crisil Integral IQ

The rising role of capital solutions and private debt in corporate restructuring

Corporate restructuring has entered a new era. Traditional bankruptcy proceedings are increasingly being replaced by alternative restructuring solutions as companies, investors and creditors seek more efficient and value-preserving mechanisms to address financial distress.

Across the United States, Europe and Asia, distressed exchanges, liability management exercises and hybrid capital solutions are gaining traction as more companies restructure their balance sheets without resorting to formal insolvency.

At the heart of this transformation is the growing role of private debt asset managers, who are now key players in restructuring transactions, offering tailored capital solutions that go beyond traditional lending.

The shift reflects not only the high costs and inefficiencies of bankruptcy but also the evolution of private debt markets, which have rapidly expanded in the last decade.

Drawbacks of bankruptcy proceedings

Distressed exchanges emerge as the preferred restructuring tool

A distressed exchange occurs when a company renegotiates its outstanding debt with creditors, often swapping it for new securities with adjusted terms. This method helps avoid formal bankruptcy while restructuring liabilities in a way that benefits both creditors and borrowers.

Key trends in distressed exchanges

These trends underscore a fundamental shift away from bankruptcy proceedings towards negotiated settlements that preserve the enterprise value.

The role of private debt asset managers in restructuring

As traditional bank lenders scale back their involvement in distressed situations, private debt asset managers have stepped in to fill the gap. These firms specialize in customized credit solutions, direct lending, and distressed investing, giving them an increasingly important role in corporate restructuring.

Why private debt funds lead corporate restructuring?

- The global private debt market has surpassed $1.6 trillion, with major growth in the US ($ 1 trillion+), Europe (€400 billion), and Asia ($300 billion)

- Companies that previously relied on leveraged loans and high-yield bonds now turn to private debt for more flexible financing options

- Regulatory frameworks such as Basel III and IV have tightened capital requirements, forcing banks to reduce exposure to distressed lending

- Private debt funds have greater flexibility to provide structured financing solutions tailored to specific corporate needs

- Private debt funds deploy bespoke capital solutions, including:

- Unitranche loans (combining senior and subordinated debt into a single facility)

- Convertible debt structures that give creditors equity upside without wiping out shareholders

- Rescue financings that bridge companies through temporary liquidity crises

Regional variations in role of private debt funds

The role of private debt funds in corporate restructuring differs in the US, Europe and Asia, influenced by legal frameworks, bank involvement and creditor rights.

|

|

United States

|

• Leading distressed exchanges and liability management transactions

|

Europe

|

• Growing involvement in sponsored-backed restructurings

|

Asia

|

• Emerging role in distressed financing; still secondary to bank-led workouts

|

While private debt funds actively lead corporate restructuring in the US and European markets, the Asian market remains largely bank-dominated. That said, the role of private debt funds is expanding rapidly in Asia.

Recent involvement of private debt asset managers in corporate restructuring

The following high-profile cases highlight the crucial role private debt asset managers play in providing tailored capital solutions and facilitating complex corporate restructuring across industries and regions:

Pluralsight restructuring (2024): A consortium of private lenders, including Blue Owl Capital and Ares Management, took control of the software company Pluralsight after its rapid business decline. This restructuring resulted in a significant loss for previous investors, with the company's valuation dropping from over $5 billion to approximately $900 million. The lenders agreed to eliminate about $1.2 billion of Pluralsight's $1.7 billion debt and injected fresh capital to stabilize the business.

Alacrity Solutions takeover (2025): BlackRock faced a $600 million loss on its private equity investment in Alacrity, an insurance outsourcing company overwhelmed by debt. The company's financial struggles led to a takeover by private debt funds, highlighting the risks associated with high leverage and the active role of private debt managers in seizing control of distressed assets.

Buca di Beppo boardroom seizure (2025): Main Street Capital, a private debt lender, took control of the board of Buca di Beppo after the restaurant chain defaulted on a $47 million loan. This aggressive move allowed Main Street to initiate a bankruptcy process and subsequently acquire the company's assets, exemplifying the activist-style tactics private debt firms are adopting to protect their interests.

Engaging private debt asset managers in restructuring offers several advantages

By leveraging these benefits, companies can navigate financial distress more effectively, often avoiding the lengthy processes and value erosion associated with traditional bankruptcy proceedings.

Looking ahead: The future of capital solutions in restructuring

As interest rates remain elevated and economic uncertainty persists, demand for efficient restructuring solutions will continue to increase.

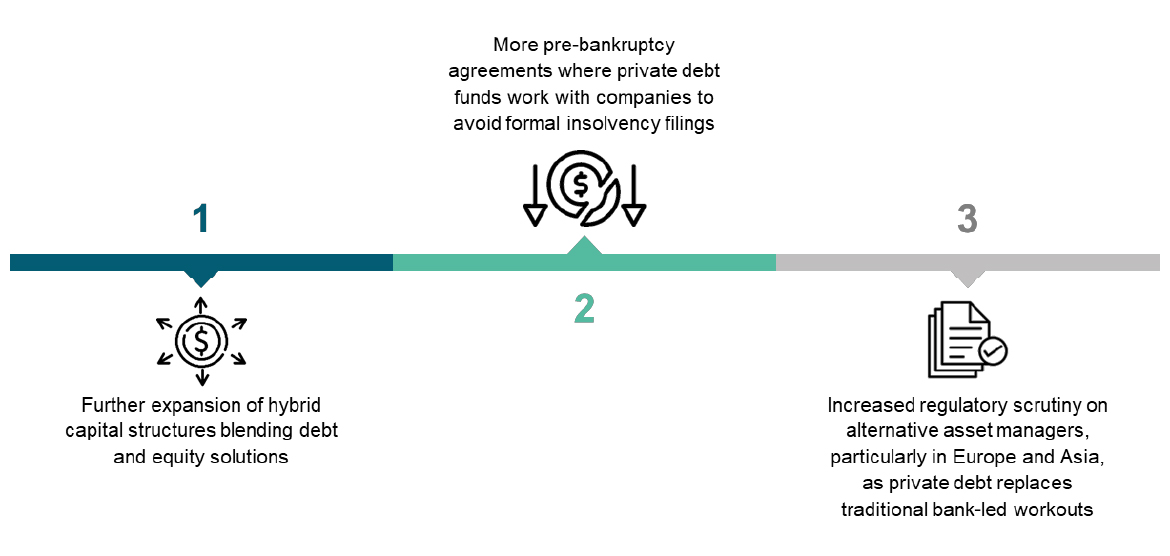

Key trends shaping the future of restructuring

In the evolving corporate restructuring landscape, private debt managers and capital solution providers will remain key to navigating financial distress.

Their ability to deploy flexible capital, engage in creditor negotiations, and drive operational efficiencies will define the future of restructuring across global markets.

Conclusion

Across the US, Europe, and Asia, companies are moving away from traditional bankruptcy and embracing alternative restructuring solutions.

- In the US, private debt and distressed exchanges are replacing Chapter 11 as the dominant restructuring mechanisms

- In Europe, restructuring is evolving into a hybrid model, balancing court-led processes with private market solutions

- In Asia, bank-led restructurings still dominate, but private debt is playing an increasingly important role in distressed situations

The global trend is clear: restructuring is becoming more flexible, creditor-driven, and private-market-focused. As this evolution continues, the role of private debt asset managers will only grow, ensuring companies can navigate financial distress efficiently while preserving long-term value.

Subscribe to our blogs