- Alternative Investment

- Technology In PE

- Private Equity Trends

Exclusive to inclusive

The democratisation of private markets

Sheetal Aggarwal

Director

Private Equity

Crisil Integral IQ

Christabel Eunice Jawahar

Senior Research Analyst

Private Equity

Crisil Integral IQ

Chetna Somany

Research Analyst

Private Equity

Crisil Integral IQ

The democratisation of private markets

Private markets tap those esoteric pockets of liquidity which public markets cannot reach. These private markets have long remained the privilege of institutional investors and high net worth individuals (HNIs) because of the inherent risk sewn into those liquidity pockets. However, private markets are becoming more accessible to a wider range of participants, driven by regulatory changes, technological advancements, evolving investor behaviour and preferences as well increased transparency and easier information availability. This process of democratisation offers a range of benefits for retail investors, such as higher returns and improved diversification.

However, challenges remain such as ensuring regulatory compliance, managing complexity and maintaining investor protection. Third-party vendors may hold the key to overcoming these challenges.

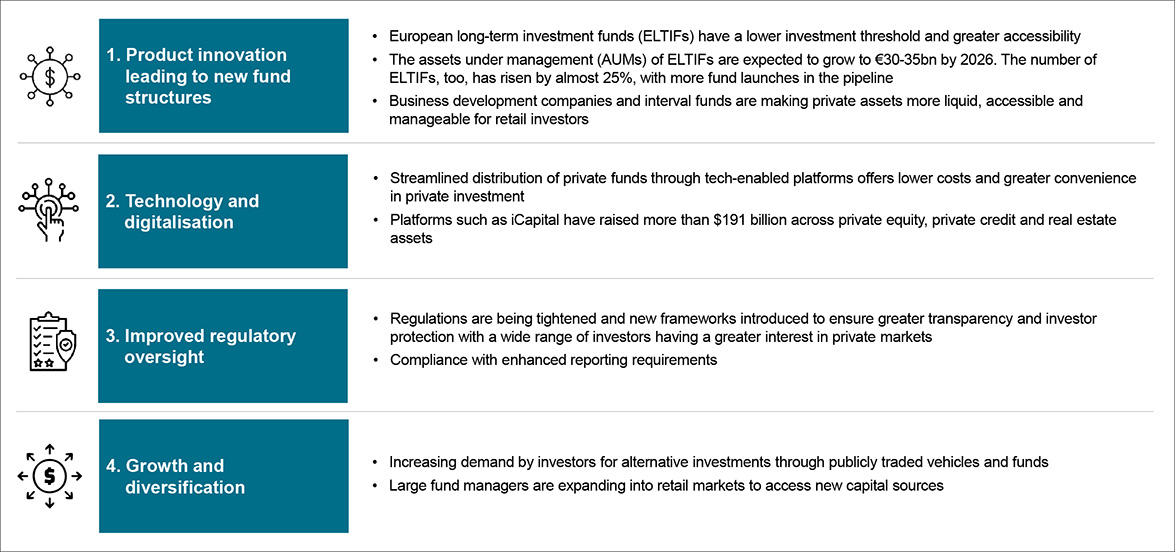

Drivers of democratisation…

… and the drags

Evolving investor behaviour

Given these drivers, a wider range of investors are turning to private markets for portfolio diversification, higher returns, regular cash flows and more control over their assets.

Institutional investors have already bought into private markets.

Pension funds and sovereign wealth funds seek long-duration assets to match their liabilities and more influence via active ownership, Board seats or veto rights and more control over their exit timings. Family offices take niche positions because of their higher risk appetite and goal alignment, and HNIs and retail investors strive to beat public market volatility and portfolio diversification amid greater financial awareness.

The participation of these investors builds credibility, while fintech platforms and lower minimum investments enable non-institutional investors such as HNIs and retail investors to participate in the private market space.

As a result, private markets are becoming more accessible, and traditional barriers to entry are being broken down.

Regulatory landscape of the private markets

Regulatory bodies are catalysing this democratisation process by introducing rules and guidelines to ensure transparency, fairness and investor protection. These regulators are pushing for greater transparency in fees and expenses, making it essential for private equity firms to review the fee structures and disclosure practices.

One key focus area is increased reporting regulations.

- The US Securities and Exchange Commission (SEC) has introduced new rules, requiring private equity firms to disclose more information about their fees, expenses and investment strategies

- The European Union’s Alternative Investment Fund Managers Directive (AIFMD) is a regulatory effort to increase transparency and oversight in private markets. The AIFMD requires private equity firms to report on their investment activities, risk-management practices and conflicts of interest

- The Financial Industry Regulatory Authority (FINRA) has introduced rules governing the sale of private investments to retail investors

Tighter scrutiny poses significant challenges for private equity firms, particularly in terms of infrastructure and resources, since many lack the requisite processes, systems and expertise to handle higher reporting and compliance requirements.

According to a survey by EY*, about 46% of the smaller private equity (PE) firms outsource some functions to third-party vendors to meet the regulatory requirements. This trend will only intensify going forward.

The infrastructure imperative

The inevitable shift

In this ongoing structural shift, general partners (GPs) and limited partners (LPs) are facing heightened scrutiny for transparency, reporting and governance.

Given the lack of infrastructure and resources, it is essential for PE firms to bring in third-party vendors to help them navigate the regulatory complexities of democratisation. These vendors can provide specialised expertise, technology and services to support PE firms in areas such as reporting and compliance.

At Crisil, we are well-positioned to help clients capitalise on opportunities presented by democratisation, while also mitigating its risks and meeting its demands through our tailored solutions and insights.

Discover how Crisil Integral IQ can help you navigate the entire investment lifecycle. Click here to explore our private equity solutions and connect with our team: link

References:

* Private Equity Survey

Subscribe to our blogs