Empowering a Top 15 G-SIB: Enhanced Risk Monitoring in Leveraged Finance and Counterparty Credit workstreams with Crisil

Background

- The engagement involved supporting the bank’s credit risk management team, i.e. the second line of defence, across the wholesale lending credit risk assessment function covering commercial lending (leveraged finance high yield credits), counterparty credit (financial institutions such as banks, insurance companies, brokers, asset managers, sovereigns, and sub-sovereigns) and municipal portfolio.

Opportunity

- The G-SIB was looking to partner with a credit specialist to improve the quality and efficiency of its risk monitoring process within its credit risk control team, covering more than 1,500 counterparties split across sectors/functions.

- The bank was facing challenges of dealing with huge annual review backlogs and managing peak workload amid increased regulatory scrutiny largely in the leveraged finance (LF) space. In addition, there were huge regional disparities and varied processes within multiple workstreams.

Solutions

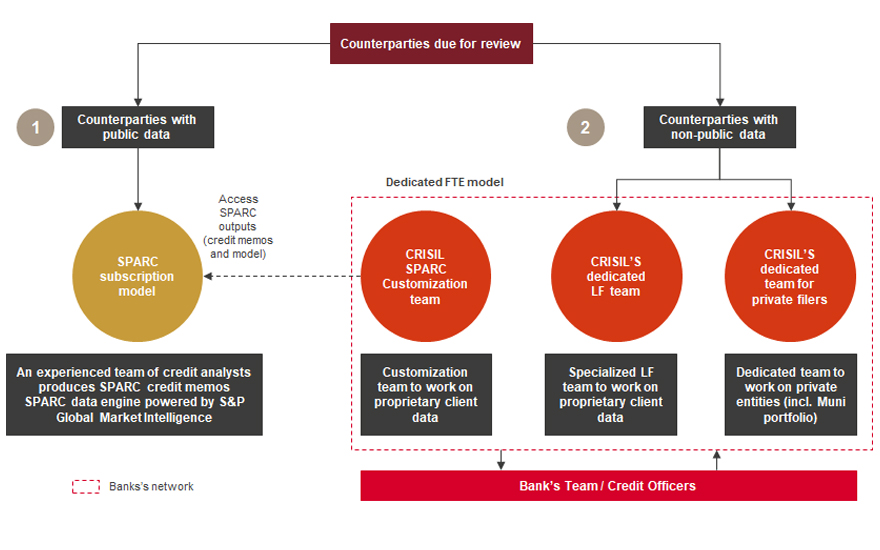

- Crisil deployed a multi-pronged hybrid solution model, covering ~1,500 counterparties spread across regions and sectors to meet the change management objective of revised review timelines and formats.

- SPARC model:

- Identified counterparties amenable for coverage under the SPARC engagement model

- SPARC is Crisil’s white-labelled product which provides credit risk assessment reports and financial models on a subscription basis for public filers including large corporates, global & large regional banks, insurance firms, AMs, broker-dealers, etc.

- SPARC provides high coverage overlap across, with ‘ready-to-use’ reports for 3,000+ entities, including non-rated and private companies

- Set up a customisation layer of FTEs to work on proprietary client data to ensure client ready outputs

- Identified counterparties amenable for coverage under the SPARC engagement model

- Dedicated FTE model:

- Identified counterparties amenable for dedicated FTE model

- Established a dedicated team with strong expertise in credit risk assessment across LF portfolio and private entity coverage

- Deployed an engagement-lead to monitor delivery schedule, quality and timelines and ensure client satisfaction

- SPARC model:

Key outcomes

- Ongoing credit risk assessment support: Provided timely support on financial spreading, internal risk ratings generation, credit risk assessments (annual/ quarterly), covenant attestation, asset-based lending collateral management software updates, and internal risk system updates

- Strong surveillance practice: Performed active surveillance of the covered portfolio by delivering event update notes for material credit events within 1-2 business days

- Compliance on timelines: Streamlined the monitoring schedule for the timely closure of annual reviews (LF and counterparty credit), while simultaneously managing the quarterly review process for the LF portfolio

- Robust quality framework: Adopted a multi-pronged quality framework that includes process manuals, data assurance, and analytical reviews

Impact

- Positive regulatory outcome: Achieved 100% accuracy ratings and excellent feedback from regulators (previously one of the major concerns for the bank) through process, content and template related improvements, and building a strong surveillance practice

- Process related improvements: Undertook thorough study of client’s risk and workflow systems, processes and sector-specific approach, identified disparities and defined priorities, streamlined workflow / processes and standardized templates, ensuring standardisation and consistency across regions and workstreams.

- Significant cost savings: Crisil’s output-based pricing (SPARC) lent flexibility to ramp up/down coverage at short notice. In addition, ongoing surveillance at no additional cost helped strengthen risk management

- Backlog clearance: Accelerated reviews helped to clear the backlog of overdue credits within the first two quarters, enabling the bank to meet its change management objective of reviewing credits over an annual cycle

- Bandwidth unlocking: The partnership with Crisil also enabled the bank to free up the bandwidth of the onshore team to generate portfolio insights and other strategic initiatives. This helped credit officers to focus on increasing the wallet share by enhancing existing client relationships and coverage expansion