Page 281 - Crisil Annual Report 2023

P. 281

Financial Statements

Standalone

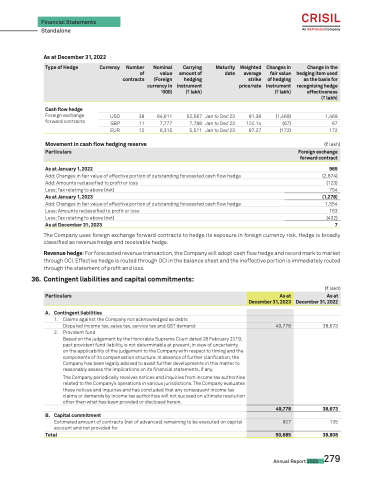

As at December 31, 2022

Cash flow hedge

Foreign exchange forward contracts

USD 38 64,611 52,567

GBP 11 7,777 7,788

EUR 12 6,315 5,511

Jan to Dec'23

Jan to Dec'23

Jan to Dec'23

cash flow hedge

cash flow hedge

81.36

100.14

87.27

(1,469)

(67)

(172)

1,469

67

172

(C lakh)

965

(2,874) (123) 754 (1,278) 1,554 163 (432) 7

Type of Hedge

Currency

Number of contracts

Nominal value (Foreign currency in ‘000)

Carrying amount of hedging instrument (C lakh)

Maturity date

Weighted average strike price/rate

Changes in fair value of hedging instrument (C lakh)

Change in the hedging item used as the basis for recognising hedge effectiveness (C lakh)

Movement in cash flow hedging reserve

As at January 1, 2022

Add: Changes in fair value of effective portion of outstanding forecasted Add: Amounts reclassified to profit or loss

Less: Tax relating to above (net)

As at January 1, 2023

Add: Changes in fair value of effective portion of outstanding forecasted Less: Amounts reclassified to profit or loss

Less: Tax relating to above (net)

As at December 31, 2023

Particulars

Foreign exchange forward contract

The Company uses foreign exchange forward contracts to hedge its exposure in foreign currency risk. Hedge is broadly classified as revenue hedge and receivable hedge.

Revenue hedge: For forecasted revenue transaction, the Company will adopt cash flow hedge and record mark to market through OCI. Effective hedge is routed through OCI in the balance sheet and the ineffective portion is immediately routed through the statement of profit and loss.

36. Contingent liabilities and capital commitments:

A. Contingent liabilities

(C lakh)

Particulars

As at December 31, 2023

As at December 31, 2022

49,778

49,778

907

50,685

1. Claims against the Company not acknowledged as debts

Disputed income tax, sales tax, service tax and GST demand: 38,673

2. Provident fund

Based on the judgement by the Honorable Supreme Court dated 28 February 2019, past provident fund liability, is not determinable at present, in view of uncertainty on the applicability of the judgement to the Company with respect to timing and the components of its compensation structure. In absence of further clarification, the Company has been legally advised to await further developments in this matter to reasonably assess the implications on its financial statements, if any.

The Company periodically receives notices and inquiries from income tax authorities related to the Company’s operations in various jurisdictions. The Company evaluates these notices and inquiries and has concluded that any consequent income tax claims or demands by income tax authorities will not succeed on ultimate resolution other than what has been provided or disclosed herein.

B. Capital commitment

38,673

Estimated amount of contracts (net of advances) remaining to be executed on capital 135

account and not provided for

Total 38,808

Annual Report 2023 279