Page 287 - Crisil Annual Report 2023

P. 287

Financial Statements

Standalone

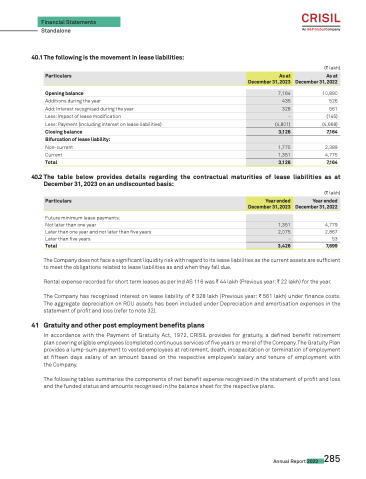

40.1 The following is the movement in lease liabilities:

Opening balance

Additions during the year

Add: Interest recognised during the year

Less: Impact of lease modification

Less: Payment (including interest on lease liabilities) Closing balance

Bifurcation of lease liability:

Non-current

Current

Total

(C lakh)

10,890 526 561 (145) (4,668) 7,164

2,389 4,775 7,164

Particulars

As at December 31, 2023

As at December 31, 2022

7,164

435

328

-

(4,801)

3,126

1,775

1,351

3,126

40.2The table below provides details regarding the contractual maturities of lease liabilities as at December 31, 2023 on an undiscounted basis:

Particulars

Year ended December 31, 2023

Year ended December 31, 2022

1,351

2,075

-

3,426

Future minimum lease payments:

Not later than one year

Later than one year and not later than five years Later than five years

Total

(C lakh)

4,779 2,867 53 7,699

The Company does not face a significant liquidity risk with regard to its lease liabilities as the current assets are sufficient to meet the obligations related to lease liabilities as and when they fall due.

Rental expense recorded for short term leases as per Ind AS 116 was C 44 lakh (Previous year: C 22 lakh) for the year.

The Company has recognised interest on lease liability of C 328 lakh (Previous year: C 561 lakh) under finance costs. The aggregate depreciation on ROU assets has been included under Depreciation and amortisation expenses in the statement of profit and loss (refer to note 32).

41 Gratuity and other post employment benefits plans

In accordance with the Payment of Gratuity Act, 1972, CRISIL provides for gratuity, a defined benefit retirement plan covering eligible employees (completed continuous services of five years or more) of the Company. The Gratuity Plan provides a lump-sum payment to vested employees at retirement, death, incapacitation or termination of employment at fifteen days salary of an amount based on the respective employee’s salary and tenure of employment with the Company.

The following tables summarise the components of net benefit expense recognised in the statement of profit and loss and the funded status and amounts recognised in the balance sheet for the respective plans.

Annual Report 2023 285