Page 222 - Index

P. 222

Consolidated

Peter Lee is an Australian research and consulting firm providing benchmarking research programs to the financial

services sector. Peter Lee conducts annual research programs across Australia and New Zealand in various areas in

banking, markets and investment management. The acquisition will complement Crisil’s existing portfolio of products

and expand offerings to new geographies and segments across financial services including commercial banks and

investment management. The deal will accelerate Crisil’s strategy in the APAC region to be the foremost player in the

growing market.

The total consideration is C 3,421 lakh (AUD 6.18 million), which includes upfront and deferred consideration.

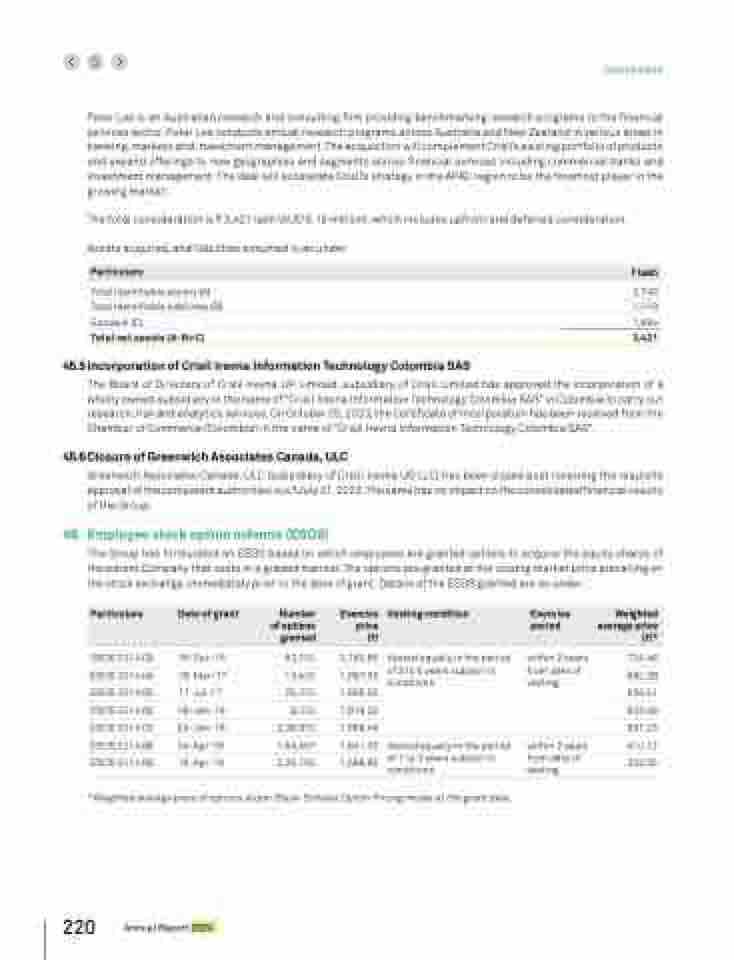

Assets acquired, and liabilities assumed is as under:

Particulars J lakh

Total identifiable assets (A) 2,746

Total identifiable liabilities (B) 1,019

Goodwill (C) 1,694

Total net assets (A-B+C) 3,421

45.5 Incorporation of Crisil Irevna Information Technology Colombia SAS

The Board of Directors of Crisil Irevna UK Limited, subsidiary of Crisil Limited has approved the incorporation of a

wholly owned subsidiary in the name of “Crisil Irevna Information Technology Colombia SAS” in Colombia to carry out

research, risk and analytics services. On October 25, 2023, the Certificate of Incorporation has been received from the

Chamber of Commerce (Colombia) in the name of “Crisil Irevna Information Technology Colombia SAS”.

45.6 Closure of Greenwich Associates Canada, ULC

Greenwich Associates Canada, ULC (subsidiary of Crisil Irevna US LLC) has been closed post receiving the requisite

approval of the competent authorities w.e.f July 31, 2023. The same has no impact on the consolidated financial results

of the Group.

46. Employee stock option scheme (ESOS)

The Group has formulated an ESOS based on which employees are granted options to acquire the equity shares of

the parent Company that vests in a graded manner. The options are granted at the closing market price prevailing on

the stock exchange, immediately prior to the date of grant. Details of the ESOS granted are as under :

Exercise

price

(J)

Vesting condition Exercise

period

Weighted

average price

(J)*

Particulars Date of grant Number

of options

granted

ESOS 2014 (3) 16-Dec-16 82,100 2,180.85 Vested equally in the period

within 2 years

734.46

of 3 to 5 years subject to

from date of

ESOS 2014 (4) 09-Mar-17 13,400 1,997.35 680.28

conditions

vesting

ESOS 2014 (5) 17-Jul-17 25,000 1,956.55 626.51

ESOS 2014 (6) 08-Jan-18 8,000 1,919.25 623.48

ESOS 2014 (7) 24-Jan-18 2,38,970 1,969.45 651.23

ESOS 2014 (8) 04-Apr-18 1,64,457 1,841.35 Vested equally in the period

within 2 years

410.12

of 1 to 3 years subject to

from date of

ESOS 2014 (9) 16-Apr-19 2,26,155 1,568.85 332.35

conditions

vesting

*Weighted average price of options as per Black-Scholes Option Pricing model at the grant date.

220 Annual Report 2024