Page 227 - Index

P. 227

Annual Report 2024

225

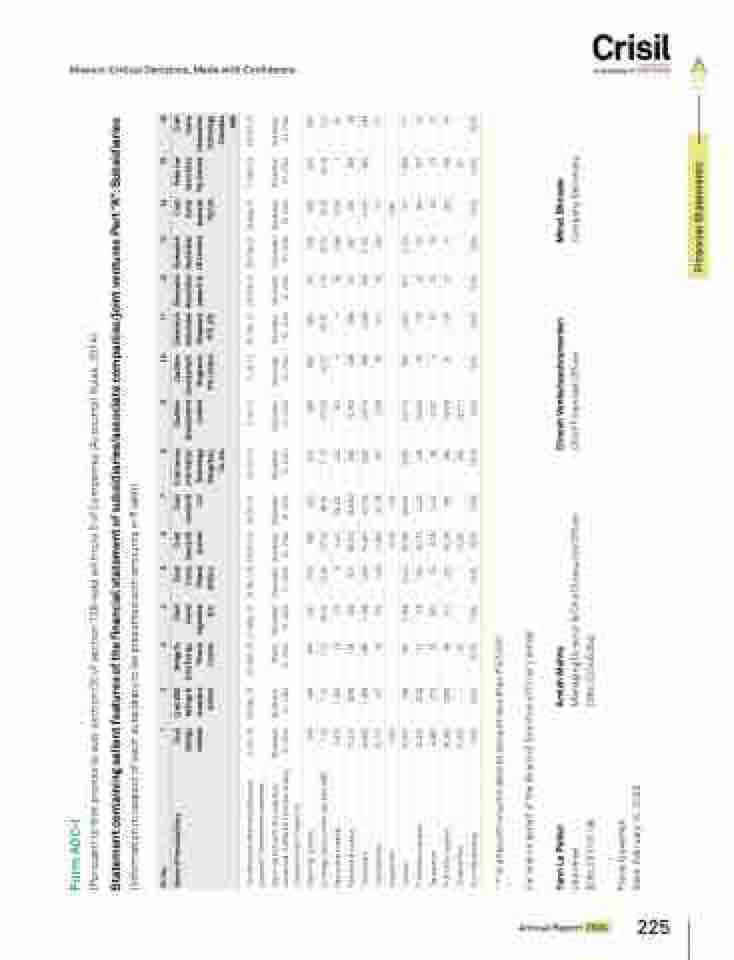

Form AOC-I

(Pursuant to first proviso to sub-section (3) of section 129 read with rule 5 of Companies (Accounts) Rules, 2014)

Statement containing salient features of the financial statement of subsidiaries/associate companies/joint ventures Part “A”: Subsidiaries

(Information in respect of each subsidiary to be presented with amounts in C lakh)

Sl. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Name of the subsidiary Crisil

Ratings

Limited

Crisil ESG

Ratings &

Analytics

Limited

Bridge To

India Energy

Private

Limited

Crisil

Irevna

Argentina

S.A.

Crisil

Irevna

Poland

SP.Zo.o.

Crisil

Irevna UK

Limited

Crisil

Irevna US

LLC

Crisil Irevna

Information

Technology

(Hangzhou)

Co. Ltd.

Coalition

Development

Limited

Coalition

Development

Singapore

Pte Limited

Greenwich

Associates

Singapore

PTE. LTD.

Greenwich

Associates

Japan K.K.

Greenwich

Associates

UK Limited

Crisil

Irevna

Australia

Pty Ltd

Peter Lee

Associates

Pty. Limited

Crisil

Irevna

Information

Technology

Colombia

SAS

The date since when subsidiary was

acquired/ Investment in subsidiary

3-Jun-19 26-Sep-23 30-Sep-23 21-May-07 14-Nov-08 19-Oct-04 19-Oct-04 22-Jul-10 3-Jul-12 3-Jul-12 26-Feb-20 26-Feb-20 26-Feb-20 28-Aug-20 17-Mar-23 25-Oct-23

Reporting period for the subsidiary

concerned, if different from the holding

Company’s reporting period

December

31, 2024

December

31, 2024

Reporting currency Total assets Total liabilities Turnover 57,970 266 300 3,358 3,040 36,759 48,052 3,520 62,713 695 2,822 911 2,125 700 1,668 711

Tax expense 8,660 (77) 23 (91) 55 (105) 1,442 63 5,167 4 50 23 25 82 (1) 27

March

December

December

December

31, 2024

31, 2024

31, 2024

31, 2024

Dividend Paid December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

December

31, 2024

INR INR INR USD PLN GBP USD CNY GBP SGD SGD JPY USD AUD AUD COP

Exchange rate as on the last date (INR) 1.00 1.00 1.00 85.54 20.89 107.59 85.54 11.72 107.59 62.97 62.97 0.54 85.54 53.18 53.18 0.02

Equity share capital 2,610 1,050 18 172 9 4,441 28,421 247 151 -* -* 65 1,089 3,335 1 84

Reserves & surplus 17,477 (229) 129 482 837 59,314 (3,994) 645 6,793 398 686 142 567 351 259 38

42,860 1,298 226 1,186 1,283 74,647 43,133 1,322 14,213 486 1,298 333 2,150 4,407 260 239

22,773 477 79 532 438 10,893 18,706 431 7,268 88 612 126 494 721 - 117

Investments 1,050 - - - - 3,419 1,154 - - - - - - 3,367 - -

Profit before taxation 33,925 (312) 112 118 260 18,173 2,423 408 20,642 35 176 43 102 364 187 74

Profit after taxation 25,265 (236) 89 210 205 18,278 981 345 15,475 31 126 20 77 282 188 47

15,800 - 130 - - 19,030 - 354 18,811 - - - - - 191 -

% of shareholding 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

‘-*’ in amounts column denote amount less than C 50,000

For and on behalf of the Board of Directors of Crisil Limited

Yann Le Pallec Amish Mehta Dinesh Venkatasubramanian Minal Bhosale

Chairman Managing Director & Chief Executive Officer Chief Financial Officer Company Secretary

[DIN: 05173118] [DIN: 00046254]

Place: Guwahati

Date: February 10, 2025

Financial Statements

Mission-Critical Decisions, Made with Confidence.