Our recommendations

- CRISIL Ratings

- Crisil Ratings

- Ratings

- Press Release

- Securitisation

- Non Banking Financial Company

Mumbai

Mumbai

Securitisation volume tangoes economic rebound, gallops 50%

Volume rose to Rs 1.35 lakh crore last fiscal, but stays below pre-pandemic levels

The securitisation market saw increased activity in the fourth quarter of fiscal 2022, with volume crossing Rs 50,000 crore. That took the cumulative value of loan assets securitised last fiscal to Rs 1.35 lakh crore, a good 50% higher compared with around Rs 90,000 crore in fiscal 2021. That compares with the pre-pandemic volume of ~Rs 1.9 lakh crore seen fiscals 2019 and 2020.

A raft of tailwinds propped the securitisation volume. Most non-banking financial companies (NBFCs1) reported an upturn in business activity, which led to improved borrower cash flows and collection efficiencies. Crisil Ratings had indicated in its press release2 the negligible impact on collections in the wake of the omicron wave.

Disbursements also picked up, necessitating incremental funding requirements. More than 130 financing entities securitised their assets in the past 12 months. Investors such as mutual funds and foreign-owned financing entities, which were chary in the recent past, picked up such securitised instruments.

Says Krishnan Sitaraman, Senior Director and Deputy Chief Ratings Officer, Crisil Ratings, “The upturn in business activity, stable collection ratios, increasing disbursements, more entities securitising assets, and the return of investors such as mutual funds are indicative of the economy rebounding. Based on fourth-quarter data, it would be safe to surmise that India’s securitisation market is coming out of the pandemic-induced stupor.”

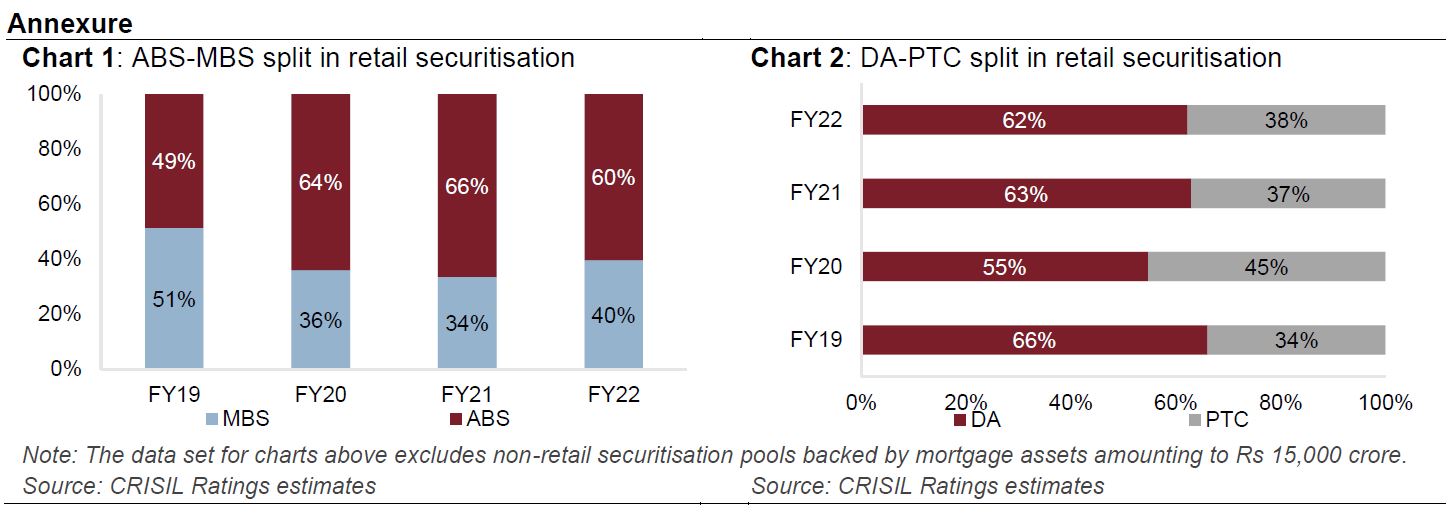

The last quarter of fiscal 2022 also saw a number of mortgage-backed deals comprising pools of non-retail loans with higher ticket sizes. The conventional retail mortgage-backed securitisation (MBS) segment accounted for 40% of the overall volume (see Chart 1 in annexure).

Within asset-backed securitisation (ABS), commercial vehicle (CV; 25%), gold (10%) and two-wheeler (2%) loans remained important asset segments. In addition, microfinance loans drew traction, comprising 10% of volume, especially in the last quarter of fiscal 2022, amid indications of resilience among low-ticket size borrowers.

The proportion of pass-through certificate (PTC) issuances rose from 37% in fiscal 2021 to 38% in fiscal 2022, while the direct assignment (DA) route continued to record higher volumes, accounting for as much as 62% of the retail assets securitised (see Chart 2 in annexure). Nearly four-fifths of the investments were by public and private sector banks, with NBFCs also playing a role in acquiring assets from other finance companies.

As the impact of the pandemic wanes, business cycles will see re-adjustments. To be sure, the pre-pandemic ‘normal’ has endured multiple iterations in the past few quarters and financing entities have incorporated many of these learnings and re-oriented their business models, operational processes, lending products and delivery mechanisms.

Says Rohit Inamdar, Senior Director, Crisil Ratings, “While the threat of an immediate disruption to business is low, resumption of business under normalised economic activity will likely be a priority for financing entities. As their lending operations evolve and funding requirements crystalise, many entities may take the securitisation route for meeting these needs.”

1 NBFCs includes housing finance companies (HFCs) and micro-finance institutions (MFIs)

2 https://www.crisil.com/en/home/newsroom/press-releases/2022/03/securitised-pool-collections-inoculated-against-disruptions.html

Subscribe for our press releases

GreyLine

Questions?

Media relations

Pankaj Rawat

Media Relations

Crisil Limited

M: +91 99 872 61199

B: +91 22 3342 3000

pankaj.rawat@crisil.comAnalytical contacts

Krishnan Sitaraman

Senior Director & Deputy Chief

Ratings Officer

Crisil Ratings Limited

D: +91 22 3342 8070

krishnan.sitaraman@crisil.comRohit Inamdar

Senior Director

Crisil Ratings Limited

D:+91 22 4040 2985

rohit.inamdar@crisil.com