Page 200 - Crisil Annual Report 2023

P. 200

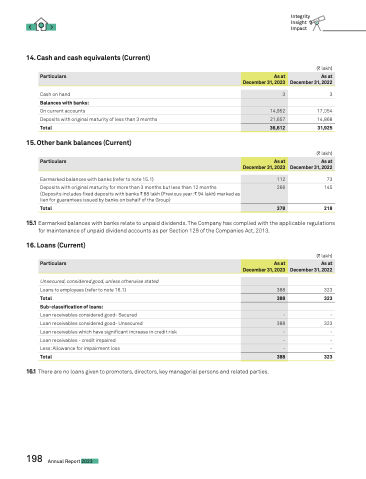

14. Cash and cash equivalents (Current)

Cash on hand

Balances with banks:

On current accounts

Deposits with original maturity of less than 3 months Total

15. Other bank balances (Current)

Earmarked balances with banks (refer to note 15.1)

Deposits with original maturity for more than 3 months but less than 12 months

{Deposits includes fixed deposits with banks C 88 lakh (Previous year: C 94 lakh) marked as lien for guarantees issued by banks on behalf of the Group}

Total

Integrity Insight Impact

(C lakh)

3

17,054 14,868 31,925

(C lakh)

73 145

218

Particulars

As at December 31, 2023

As at December 31, 2022

3

14,952

21,657

36,612

Particulars

As at December 31, 2023

As at December 31, 2022

112

266

378

15.1 Earmarked balances with banks relate to unpaid dividends. The Company has complied with the applicable regulations for maintenance of unpaid dividend accounts as per Section 129 of the Companies Act, 2013.

16. Loans (Current)

(C lakh)

Unsecured, considered good, unless otherwise stated

Loans to employees (refer to note 16.1) 323 Total 323 Sub-classification of loans:

Loan receivables considered good- Secured - Loan receivables considered good- Unsecured 323 Loan receivables which have significant increase in credit risk - Loan receivables - credit impaired - Less: Allowance for impairment loss - Total 323

16.1 There are no loans given to promoters, directors, key managerial persons and related parties.

Particulars

As at December 31, 2023

As at December 31, 2022

388

388

-

388

-

-

-

388

198 Annual Report 2023