Page 201 - Crisil Annual Report 2023

P. 201

Financial Statements

Consolidated

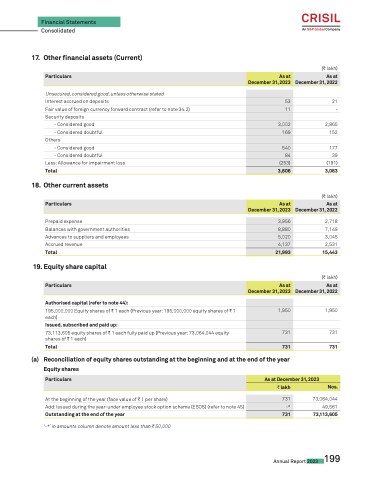

17. Other financial assets (Current)

Unsecured, considered good, unless otherwise stated

Interest accrued on deposits

Fair value of foreign currency forward contract (refer to note 34.2) Security deposits

- Considered good

- Considered doubtful Others

- Considered good

- Considered doubtful

Less: Allowance for impairment loss Total

18. Other current assets

Prepaid expense

Balances with government authorities Advances to suppliers and employees Accrued revenue

Total

19. Equity share capital

Authorised capital (refer to note 44):

195,000,000 Equity shares of C 1 each (Previous year: 195,000,000 equity shares of C 1 each)

Issued, subscribed and paid up:

73,113,605 equity shares of C 1 each fully paid up (Previous year: 73,064,044 equity shares of C 1 each)

Total

(a) Reconciliation of equity shares outstanding at the beginning and at the end of the year Equity shares

At the beginning of the year (face value of C 1 per share)

Add: Issued during the year-under employee stock option scheme (ESOS) (refer to note 45) Outstanding at the end of the year

‘-*’ in amounts column denote amount less than C 50,000

(C lakh)

21 -

2,865 152

177 39 (191) 3,063

(C lakh)

2,718 7,149 3,045 2,531

15,443

(C lakh)

1,950 731

731

73,064,044 49,561 73,113,605

Particulars

As at December 31, 2023

As at December 31, 2022

53

11

3,002

169

540

84

(253)

3,606

Particulars

As at December 31, 2023

As at December 31, 2022

3,956

8,880

5,020

4,137

21,993

Particulars

As at December 31, 2023

As at December 31, 2022

1,950

731

731

Particulars

As at December 31, 2023

C lakh

Nos.

731

-*

731

Annual Report 2023 199