Page 203 - Crisil Annual Report 2023

P. 203

Financial Statements

Consolidated

Equity shares of C 1 each fully paid

1. Group Holding of the S&P Global Inc.

a) S&P India, LLC

b) S&P Global Asian Holdings Pte. Limited

c) Standard & Poor's International LLC

2. Jhunjhunwala Rekha Rakesh

42.72%

15.77% 8.21% 5.47%

31,209,480

11,523,106 6,000,000 4,000,000

Name of the shareholder

As at December 31, 2022

% holding in the class

Nos.

As per records of the Company, including its register of shareholders/ members and other declarations received from shareholders regarding beneficial interest, the above shareholding represents both legal and beneficial ownerships of shares.

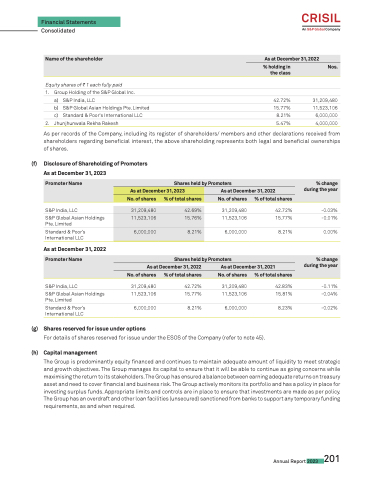

(f) Disclosure of Shareholding of Promoters As at December 31, 2023

Promoter Name

Shares held by Promoters

% change during the year

As at December 31, 2023

As at December 31, 2022

No. of shares

% of total shares

No. of shares

% of total shares

31,209,480

42.69%

11,523,106

15.76%

6,000,000

8.21%

S&P India, LLC

S&P Global Asian Holdings Pte. Limited

Standard & Poor’s International LLC

As at December 31, 2022

S&P India, LLC

S&P Global Asian Holdings Pte. Limited

Standard & Poor’s International LLC

31,209,480

11,523,106

6,000,000

42.72%

15.77%

8.21%

31,209,480

11,523,106

6,000,000

31,209,480

11,523,106

6,000,000

42.72% -0.03%

15.77% -0.01%

8.21% 0.00%

42.83% -0.11%

15.81% -0.04%

8.23% -0.02%

Promoter Name

Shares held by Promoters

% change during the year

As at December 31, 2022

As at December 31, 2021

No. of shares

% of total shares

No. of shares

% of total shares

(g) Shares reserved for issue under options

For details of shares reserved for issue under the ESOS of the Company (refer to note 45).

(h) Capital management

The Group is predominantly equity financed and continues to maintain adequate amount of liquidity to meet strategic and growth objectives. The Group manages its capital to ensure that it will be able to continue as going concerns while maximising the return to its stakeholders. The Group has ensured a balance between earning adequate returns on treasury asset and need to cover financial and business risk. The Group actively monitors its portfolio and has a policy in place for investing surplus funds. Appropriate limits and controls are in place to ensure that investments are made as per policy. The Group has an overdraft and other loan facilities (unsecured) sanctioned from banks to support any temporary funding requirements, as and when required.

Annual Report 2023 201