Page 204 - Crisil Annual Report 2023

P. 204

The general reserve is used from time to time to transfer profits from retained earnings for appropriation purposes. As the general reserve is created by a transfer from one component of equity to another and is not an item of other comprehensive income, items included in the general reserve will not be reclassified subsequently to the retained earnings.

b) Securities premium

The amount received in excess of face value of the equity shares is recognised in securities premium.

c) Share based payment reserve

The share based payment reserve account is used to record the value of equity-settled share based payment transactions with employees. The amounts recorded in this account are transferred to share premium upon exercise of stock options by employees.

d) Other comprehensive income (OCI)

Other comprehensive income includes fair value changes in equity instruments, hedge reserve and currency fluctuation reserve through OCI.

e) Hedge reserve

Forward contracts are stated at fair value at each reporting date. Changes in the fair value of the forward contracts that are designated and effective as hedges of future cash flows are recognised directly in OCI and accumulated under the hedging cash flow hedge reserve, net of applicable deferred income taxes.

f) Currency fluctuation reserve

Exchange difference relating to the translation of the results and net assets of the Group’s foreign operations from their respective functional currencies to the Group’s functional currency is recognised directly in other comprehensive income and accumulated in the currency fluctuation reserve.

g) Retained earnings

Retained earnings represent the cumulative profits of the Group and the effects of measurements of defined benefit obligation.

h) Capital redemption reserve

The Group has recognised capital redemption reserve on buyback of equity shares from its retained earnings. The amount in capital redemption reserve is equal to nominal amount of the equity shares bought back.

i) Share application money pending allotment

It represent the amount received on the application on which allotment is not yet made (pending allotment).

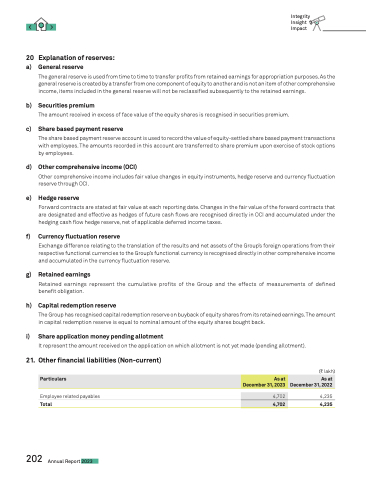

21. Other financial liabilities (Non-current)

Employee related payables

Total

(C lakh)

4,235

4,235

Integrity Insight Impact

20 Explanation of reserves: a) General reserve

Particulars

As at December 31, 2023

As at December 31, 2022

4,702

4,702

202 Annual Report 2023