Page 206 - Crisil Annual Report 2023

P. 206

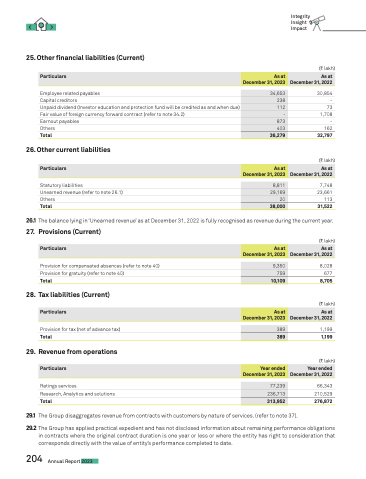

25. Other financial liabilities (Current)

Employee related payables

Capital creditors

Unpaid dividend (Investor education and protection fund will be credited as and when due) Fair value of foreign currency forward contract (refer to note 34.2)

Earnout payables

Others

Total

26. Other current liabilities

Statutory liabilities

Unearned revenue (refer to note 26.1) Others

Total

Integrity Insight Impact

(C lakh)

30,854 -

73 1,708 - 162 32,797

(C lakh)

7,748 23,661 113 31,522

Particulars

As at December 31, 2023

As at December 31, 2022

34,653

238

112

-

873

403

36,279

Particulars

As at December 31, 2023

As at December 31, 2022

8,811

29,169

20

38,000

26.1 The balance lying in ‘Unearned revenue’ as at December 31, 2022 is fully recognised as revenue during the current year. 27. Provisions (Current)

Particulars

As at December 31, 2023

As at December 31, 2022

9,350

759

10,109

Provision for compensated absences (refer to note 40) Provision for gratuity (refer to note 40)

Total

28. Tax liabilities (Current)

Provision for tax (net of advance tax)

Total

29. Revenue from operations

Ratings services

Research, Analytics and solutions Total

29.1 The Group disaggregates revenue from contracts with customers by nature of services. (refer to note 37).

(C lakh)

8,028 677 8,705

(C lakh)

1,199

1,199

(C lakh)

66,343 210,529 276,872

Particulars

As at December 31, 2023

As at December 31, 2022

389

389

Particulars

Year ended December 31, 2023

Year ended December 31, 2022

77,239

236,713

313,952

29.2 The Group has applied practical expedient and has not disclosed information about remaining performance obligations in contracts where the original contract duration is one year or less or where the entity has right to consideration that corresponds directly with the value of entity’s performance completed to date.

204 Annual Report 2023