Page 208 - Crisil Annual Report 2023

P. 208

Particulars

Year ended December 31, 2023

Year ended December 31, 2022

335

3,941

1,554

297

316

158

12,622

14,762

4,351

62

23

895

272

1,745

436

522

51,025

Printing and stationery

Conveyance and travelling

Books and periodicals

Remuneration to non-whole time directors (refer to note 38) Business promotion and advertisement

Foreign exchange loss

Professional fees

Associate service fee

Software purchase and maintenance expenses Provision for doubtful trade receivables Provision on other financial assets

Corporate social responsibility (CSR) expenses (refer to note 38) Auditors' remuneration

Recruitment expenses

Sales commission

Miscellaneous expenses

Total

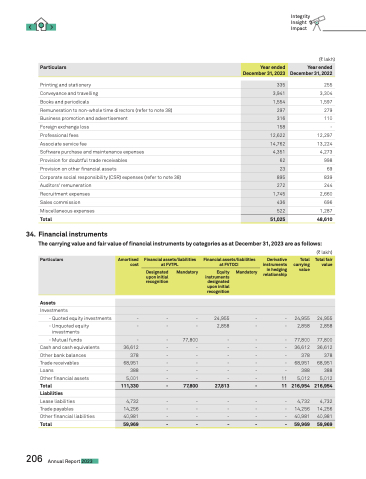

34. Financial instruments

Integrity Insight Impact

(C lakh)

255 3,304 1,597 279 110 - 12,297 13,224 4,273 998 69 839 244 2,660 696 1,287 48,610

The carrying value and fair value of financial instruments by categories as at December 31, 2023 are as follows:

(C lakh)

Particulars

Amortised cost

Financial assets/liabilities at FVTPL

Financial assets/liabilities at FVTOCI

Derivative instruments in hedging relationship

Total carrying value

Total fair value

Designated upon initial recognition

Mandatory

Equity instruments designated upon initial recognition

Mandatory

-

-

-

24,955

-

-

24,955

24,955

-

-

-

2,858

-

-

2,858

2,858

-

-

77,800

-

-

-

77,800

77,800

36,612

-

-

-

-

-

36,612

36,612

378

-

-

-

-

-

378

378

68,951

-

-

-

-

-

68,951

68,951

388

-

-

-

-

-

388

388

5,001

-

-

-

-

11

5,012

5,012

111,330

-

77,800

27,813

-

11

216,954

216,954

4,732

-

-

-

-

-

4,732

4,732

14,256

-

-

-

-

-

14,256

14,256

40,981

-

-

-

-

-

40,981

40,981

59,969

-

-

-

-

-

59,969

59,969

Assets

Investments

- Quoted equity investments

- Unquoted equity investments

- Mutual funds

Cash and cash equivalents Other bank balances Trade receivables

Loans

Other financial assets Total

Liabilities

Lease liabilities

Trade payables

Other financial liabilities Total

206 Annual Report 2023