Page 78 - Crisil Annual Report 2023

P. 78

10. Provisions and other liabilities

Provisions represent funds put aside by the Group to cover anticipated obligation in the future as a result of past event.

A. Provision for employee benefits

The overall liability was C141.49 crore as at December 31, 2023, compared with C 115.93 crore in the previous year.

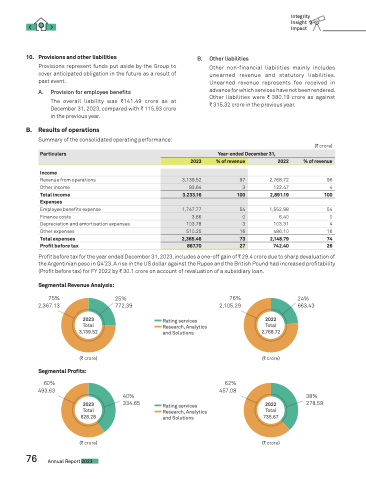

B. Results of operations

Summary of the consolidated operating performance:

Income

Revenue from operations Other income

Total income

Expenses

Employee benefits expense

Finance costs

Depreciation and amortisation expenses Other expenses

Total expenses Profit before tax

B.

Other liabilities

Other non-financial liabilities mainly includes unearned revenue and statutory liabilities. Unearned revenue represents fee received in advance for which services have not been rendered. Other liabilities were C 380.19 crore as against C 315.32 crore in the previous year.

(C crore)

2,768.72 96

122.47 4

2,891.19 100

1,552.98 54

6.40 0

103.31 4

486.10 16

2,148.79 74

742.40 26

Integrity Insight Impact

Particulars

Year-ended December 31,

2023

% of revenue

2022

% of revenue

3,139.52

97

93.64

3

3.233.16

100

1,747.77

54

3.66

0

103.78

3

510.25

16

2,365.46

73

867.70

27

Profit before tax for the year ended December 31, 2023, includes a one-off gain of C 29.4 crore due to sharp devaluation of the Argentinian peso in Q4’23. A rise in the US dollar against the Rupee and the British Pound had increased profitability (Profit before tax) for FY 2022 by C 30.1 crore on account of revaluation of a subsidiary loan.

Segmental Revenue Analysis:

75% 2,367.13

25% 772.39

76% 2,105.29

24% 663.43

(C crore) Segmental Profits:

60% 493.63

40% 334.65

62% 457.08

38% 2022 278.59

Total 735.67

(C crore)

2023

Total 3,139.52

Rating services Research, Analytics and Solutions

Rating services Research, Analytics and Solutions

2022

Total 2,768.72

(C crore)

76

(C crore) Annual Report 2023

2023

Total 828.28