Page 82 - Crisil Annual Report 2023

P. 82

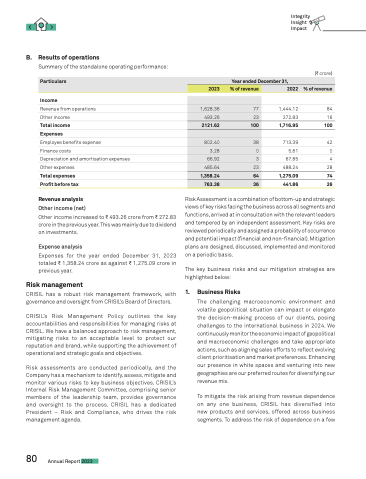

B. Results of operations

Summary of the standalone operating performance:

Income

Revenue from operations Other income

Total income

Expenses

Employee benefits expense

Finance costs

Depreciation and amortisation expenses Other expenses

Total expenses Profit before tax

Revenue analysis

Other income (net)

Other income increased to C 493.26 crore from C 272.83 crore in the previous year. This was mainly due to dividend on investments.

Expense analysis

Expenses for the year ended December 31, 2023 totaled C 1,358.24 crore as against C 1,275.09 crore in previous year.

Risk management

CRISIL has a robust risk management framework, with governance and oversight from CRISIL’s Board of Directors.

CRISIL’s Risk Management Policy outlines the key accountabilities and responsibilities for managing risks at CRISIL. We have a balanced approach to risk management, mitigating risks to an acceptable level to protect our reputation and brand, while supporting the achievement of operational and strategic goals and objectives.

Risk assessments are conducted periodically, and the Company has a mechanism to identify, assess, mitigate and monitor various risks to key business objectives. CRISIL’s Internal Risk Management Committee, comprising senior members of the leadership team, provides governance and oversight to the process. CRISIL has a dedicated President – Risk and Compliance, who drives the risk management agenda.

Integrity Insight Impact

(C crore)

Particulars

Year ended December 31,

2023

% of revenue

2022

% of revenue

1,628.36

77

493.26

23

2121.62

100

802.40

38

3.28

0

66.92

3

485.64

23

1,358.24

64

763.38

36

1,444.12 84

272.83 16

1,716.95 100

713.39 42

5.61 0

67.85 4

488.24 28

1,275.09 74

441.86 26

Risk Assessment is a combination of bottom-up and strategic views of key risks facing the business across all segments and functions, arrived at in consultation with the relevant leaders and tempered by an independent assessment. Key risks are reviewed periodically and assigned a probability of occurrence and potential impact (financial and non-financial). Mitigation plans are designed, discussed, implemented and monitored on a periodic basis.

The key business risks and our mitigation strategies are highlighted below:

1. Business Risks

The challenging macroeconomic environment and volatile geopolitical situation can impact or elongate the decision-making process of our clients, posing challenges to the international business in 2024. We continuously monitor the economic impact of geopolitical and macroeconomic challenges and take appropriate actions, such as aligning sales efforts to reflect evolving client prioritisation and market preferences. Enhancing our presence in white spaces and venturing into new geographies are our preferred routes for diversifying our revenue mix.

To mitigate the risk arising from revenue dependence on any one business, CRISIL has diversified into new products and services, offered across business segments. To address the risk of dependence on a few

80

Annual Report 2023